Are you considering purchasing an electric vehicle but worried about the insurance cost? Insuring an electric car can be more expensive than a gas-powered car due to higher purchase and repair costs. However, there are ways to save on insurance, and the benefits of driving an electric vehicle may outweigh the higher premiums.

This article will explore everything you need to know about electric vehicle insurance costs. We’ll discuss the factors that affect insurance premiums, such as the cost of the vehicle, repair costs, and safety features.

We’ll also provide tips on saving on insurance and examine the differences between electric and traditional car insurance. Whether you’re a current electric car owner or considering purchasing one, this article will provide valuable insights into electric vehicle insurance.

How Much Does It Cost To Insure an Electric Car?

If you’re considering purchasing an electric car, it’s important to know that the cost of insurance may be higher than for a gas-powered car. The national average premium for an electric vehicle is $2,280 per year. However, don’t let that deter you from enjoying the many benefits of driving an eco-friendly car.

There are ways to save on electric car insurance, such as comparing quotes from different insurance providers, taking advantage of discounts for electric car owners, and choosing the right type of coverage for your needs. Factors affecting electric car insurance include driving history, claims history, driving experience, location, coverage, deductible amount, and credit-based insurance score.

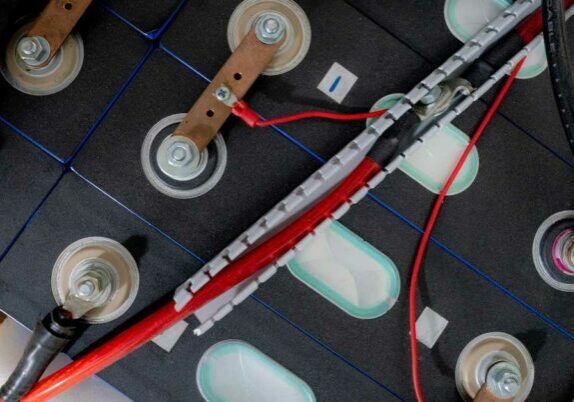

Replacing a damaged battery in an EV can range between $5,000 to $15,000, which may impact insurance rates. However, as electric cars become more common, insurance costs may decrease. Comparing electric car insurance quotes from different providers and taking advantage of discounts can help you find affordable coverage.

Why Is It More Expensive To Insure Electric Vehicles?

Understanding why electric cars are pricier to insure can help you make informed decisions regarding protecting your investment. Factors contributing to the higher insurance costs of electric vehicles include their higher purchase and repair costs.

Due to the limited number of mechanics with the required skill sets, repairing electric vehicles may be more costly. As electric cars become more common, insurance costs may decrease, but they remain higher than traditional gas-powered vehicles.

Although discounts for electric vehicles may be limited, Tesla owners can purchase Tesla Insurance through the company’s mobile app. It’s also advisable to comparison-shop for insurance policies, as different companies offer discounts such as bundling, good student, claims-free, and paperless billing.

It’s essential to consider specific electric car models when evaluating rates, as rates vary widely. Despite higher insurance costs, the benefits of owning an electric vehicle, such as reduced carbon footprint, energy independence, and lower fuel expenses, may outweigh the higher insurance premiums.

Where Can I Buy Insurance for an Electric Car?

When buying coverage for your electric ride, shop around and compare policies from different carriers to find the best deal that suits your needs and budget.

Remember the adage: “Don’t put all your eggs in one basket.”

Many insurance providers offer coverage options specifically designed for electric cars, so you can choose the policy that meets your needs. Be sure to check state requirements and policy limits when comparing different options.

In addition to comparing policies, it’s important to consider factors such as the claims process, customer service, and renewal process when choosing an insurance provider.

Some companies offer discounts for electric car owners, such as bundling with home insurance or discounts for safe driving.

Comparison shopping and researching different providers can help you find the right coverage for your electric vehicle at a price that fits your budget.

What Is the Cheapest Electric Vehicle To Insure?

To find the cheapest electric car to insure, you should consider several factors that affect the insurance cost. The make and model of the vehicle play a significant role, as well as your driving history and the coverage options available from different insurance providers. Comparison shopping can help you find the best policy for your needs, and discounts are often available for electric car owners.

Tesla owners can purchase Tesla Insurance through the company’s mobile app, while other companies offer discounts such as bundling, good student, claims-free, and paperless billing. As electric vehicles become more common, costs may decrease, so staying informed about market trends is essential.

In addition to cost savings on gas and maintenance, electric vehicles can have environmental benefits and contribute to a reduced carbon footprint. Experts and contributors at Bankrate emphasize the importance of following their editorial policy to ensure accuracy and impartiality in their reporting on electric vehicle insurance.

By considering the factors that affect insurance costs and shopping around for the best policy, you can find affordable insurance for your electric car.

Can You Save Money in Other Ways With Electric Vehicles?

Hey, you savvy saver, imagine a world where you never have to pull over for gas station fill-ups or fork over your hard-earned cash for costly oil changes – that’s just one of the many ways an electric car can save you money!

But did you know there are even more ways to save with electric vehicles? For starters, many states offer tax incentives for purchasing an electric car, which can significantly reduce the sticker price. And while maintenance costs for an electric car may be higher up front, they can save you money in the long run due to fewer required repairs and oil changes. Electric cars have higher resale value, meaning you can recoup more of your initial investment when it’s time to upgrade.

Another way to save money with an electric car is by taking advantage of charging options. Installing a home charging station can be a convenient and cost-effective way to keep your vehicle charged, especially if you have a fixed rate for electricity. Public charging networks are also expanding, with many offering free or low-cost charging options. And while range anxiety may have been a concern, many newer electric cars now offer longer driving ranges, making it easier to plan long road trips.

Overall, an electric car can save you money on fuel and maintenance costs and offer environmental benefits and a more convenient driving experience.

Final Thoughts

Congratulations on making it to the end of this article on electric vehicle insurance costs. By now, you should better understand why it can be more expensive to insure an electric car and how you can save money on insurance.

However, owning an electric vehicle is not just about saving on insurance costs. It’s about positively impacting the environment and contributing to a sustainable future. Driving an electric car is like planting a tree. Just as a single tree can make a small difference in the world, driving an electric car can make a small but significant impact on reducing carbon emissions.

So, if you’re considering purchasing an electric vehicle, don’t let the insurance costs deter you. Instead, consider it an investment in a cleaner, greener future.